On May 5th we hosted our Digital Velocity ‘22: The Ultimate Financial CX Event where we took a deep dive into building out the customer experience for financial services. Closing many brick and mortar spaces during the pandemic, the financial service industry was forced to move a lot of their practices online, enabling a period of innovation and technology. Now, knowing that consumers are not only capable of these new financial practices but actively desire these new online services, financial services are continuing their maturation to meet the demand created.

If you missed our Digital Velocity ‘22: The Ultimate Financial CX you can watch the On Demand recording and find out what leaders in the field see as our next steps to success!

Here are the Top 5 Key Takeaways on Customer Experience for Financial Services in 2022

1. Keep Moving Towards Customer Centric Personalization

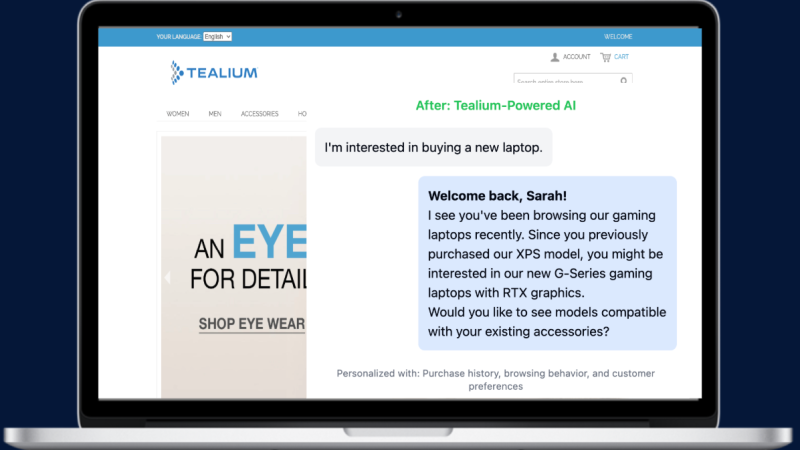

Currently, a lot of finserv companies still lack the total infrastructure needed – and thus the ability – to have customer centric personalization that would help grow their business exponentially. Being able to understand and use the data you are already collecting to gain a deeper understanding and picture of your consumer will, in the long run, allow you to be more profitable, more desirable and easier to work with.

“Financial Service firms want to be customer centric organizations. They want to bring customer data together to understand their customers, which will enable better customer experiences. In order to serve our customers in a respectful and consent managed way, we have to collect data from all channels, develop insights from that, and then create more personalization” –Kevin Farley, Global Head, Marketing Analytics, Capgemini

2. Integrate Use Cases Across Your Organization

Instead of simply purchasing customer data technology and isolating it within a single silo in your organization, integrate this technology with the rest of your technical infrastructure. Having a vendor-neutral CDP makes this large scale integration in your tech stack much easier. Oftentimes, CDP’s are seen as purely a marketing tool, which could not be further from the truth. In order to truly get the most out of your CDP it is beneficial to have all branches in your organization bought in and educated on what CDPs can do to make their jobs easier. Do not just look for one department of your company to succeed with this technology, but create cross-departmental usage so that your entire organization can benefit and excel.

“Companies that struggle will implement the technology first, and not focus on enabling. Success requires an integrated experience architecture with data, orchestration layer, channel activation layer, all the necessary things needed to see something real happen with the market. It’s a vertically integrated set of solutions that must come together to drive the use case. Operators and users also usually take a backseat, but it’s good to have them involved early on from a change management standpoint, and also good to think about how experience architecture can enable future and new interactions. These teams will think of all these things they couldn’t do before.” – Justin Sanderson, Managing Director, Accenture

3. Help Your Teams Embrace Organizational and Industry Changes

While the financial service industry is constantly changing, the pandemic expedited this process, forcing companies to evolve and rely on their online and mobile forms of banking. Accepting this change and focusing on attainable goals will encourage the growth needed to keep up with this rapidly changing market. Enabling your team’s understanding and activation of the customer data available through mobile banking will change the way you interact with your customers for the better.

“It involves the individual contributor embracing change. Focusing on goals in a great way to get a lot of people aligned specifically on one initiative and then being able to replicate across other initiatives, and then across the org. Data quality is critical.” – Jetta Hansen, Senior Data Analyst, Nav

“Change management starts with getting the right people engaged soon, help shape the vision for buy-in, and ultimately hold hands to achieve that vision.” – Greg Riedel, Senior Marketing Officer, USAA

4. Choose a CDP that Aids in Privacy and Data Governance

As guidelines are constantly changing in regards to the types of data you are allowed to collect, it is hard to keep track and make sure that your company is operating safely. Having a CDP that can integrate and communicate with your other tools removes a lot of privacy compliance and data governance leg work, simplifying your workload and opening your teams up to more strategic work. As we move into these data centered environments, working with a central hub that you can trust to follow all guidelines to organize your data is necessary.

“Having a tool like Tealium that is able to decide and anonymize what data you send to other tools, including other downstream tools and marketing tools, and having Tealium act like a hub to determine what data goes where is great. Understanding what data goes where by having this tool in the middle allows you to understand your customer.” – Aimee Bos, VP Analytics & Data Strategy, Zion and Zion

5. Prioritize your Processes for Managing First Party Data

First party data is your best asset. But knowing what you want to do with your data – and how you want to achieve those customer experience for financial services goals – is half the job. Your company is already collecting some first party, therefore understanding the proper way to collect and interpret this data is a logical next step. Approaching your data in a goal-oriented manner and defining how you want to analyze it is a game changer. Once you have a goal in mind and an idea of what you want to find in your data your CDP will take care of the rest.

“My advice for implementing a CDP is understanding that your first party data is your best asset, so you must capture it in a normalized and clean way so you can take action. We shifted to first party data to build our own attribution models to understand the effectiveness of our campaigns across channels – like Facebook and Google.” – Jason Paddock, Sr Director, Marketing Data & Technology, Oportun

Watch our On Demand recording of Digital Velocity ’22: The Financial Services CX Event now and learn even more about creating an amazing customer experience for financial services! And be sure to check out the rest of our Digital Velocity 2022 line-up for Retail, Sports & Entertainment, Travel and Hospitality, and Healthcare. Even if it’s outside your industry, there are still incredible insights and ideas to be discovered for powering up your CDP!